Service Design in Consumer Banking: the challenges and opportunities

Last month the people from Irish UX consultancy Frontend Design looked at the UX revolution in healthcare and how changes in that sector are moving towards putting the customer at the centre of the service.

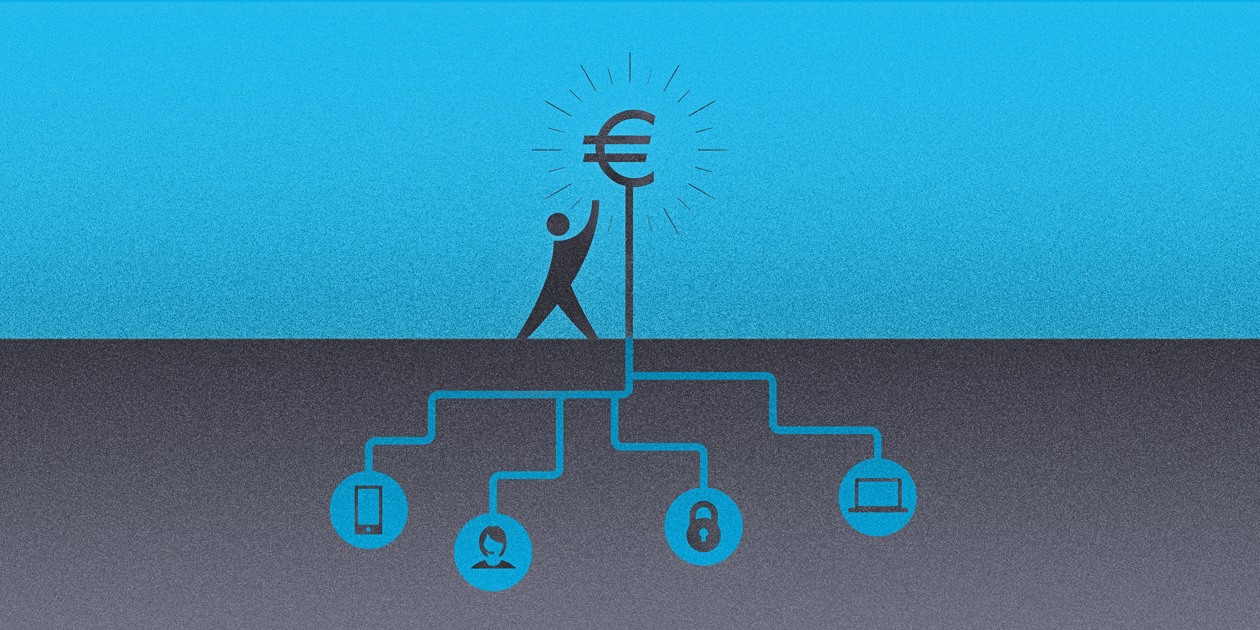

The banking sector is experiencing similar upheaval at the moment and facing similar challenges. In this month’s article, we look at six design problems specific to banks and how these challenges offer opportunities to re-imagine banking as a service.

1. Losing the personal touch

2. Neglecting the Total Customer Journey

3. Departmental silos

4. The compliance barrier

5. Missing the opportunity to leverage ‘Big Data’

6. Commodification of products and services

The author concludes: “It’s [the] customer apathy towards banks that offers the chance to make an impact. An outstanding customer experience that integrates channels can increase customer loyalty and encourage uptake of products and services within the same bank. And it’s self-perpetuating: the more products a customer has with a financial institution the more the bank can understand the customer’s needs and behaviours, providing even greater opportunity to strengthen the relationship.”