Why insurers need to care more about customers and how to do it in the digital age

COVID-19 has changed the way we live and shop, write in another article by the Swiss Re Institute.

Amid the turmoil coronavirus has created, consumers are looking for information and clarity from the companies they frequent on how to best protect themselves and how to protect others. Insurers have failed to meet this demand. Most consumers have not heard from their insurance companies so far during the pandemic. The majority of those who did hear from their life, property or health insurance provider only received a mass communication.

The digital transformation offers insurers more opportunities to interact with customers. To create these touchpoints, insurers need to understand what drives people’s behaviour and decision-making. Insurers also need overcome the interpersonal barriers created by digital interfaces and emotionally connect with their customers.

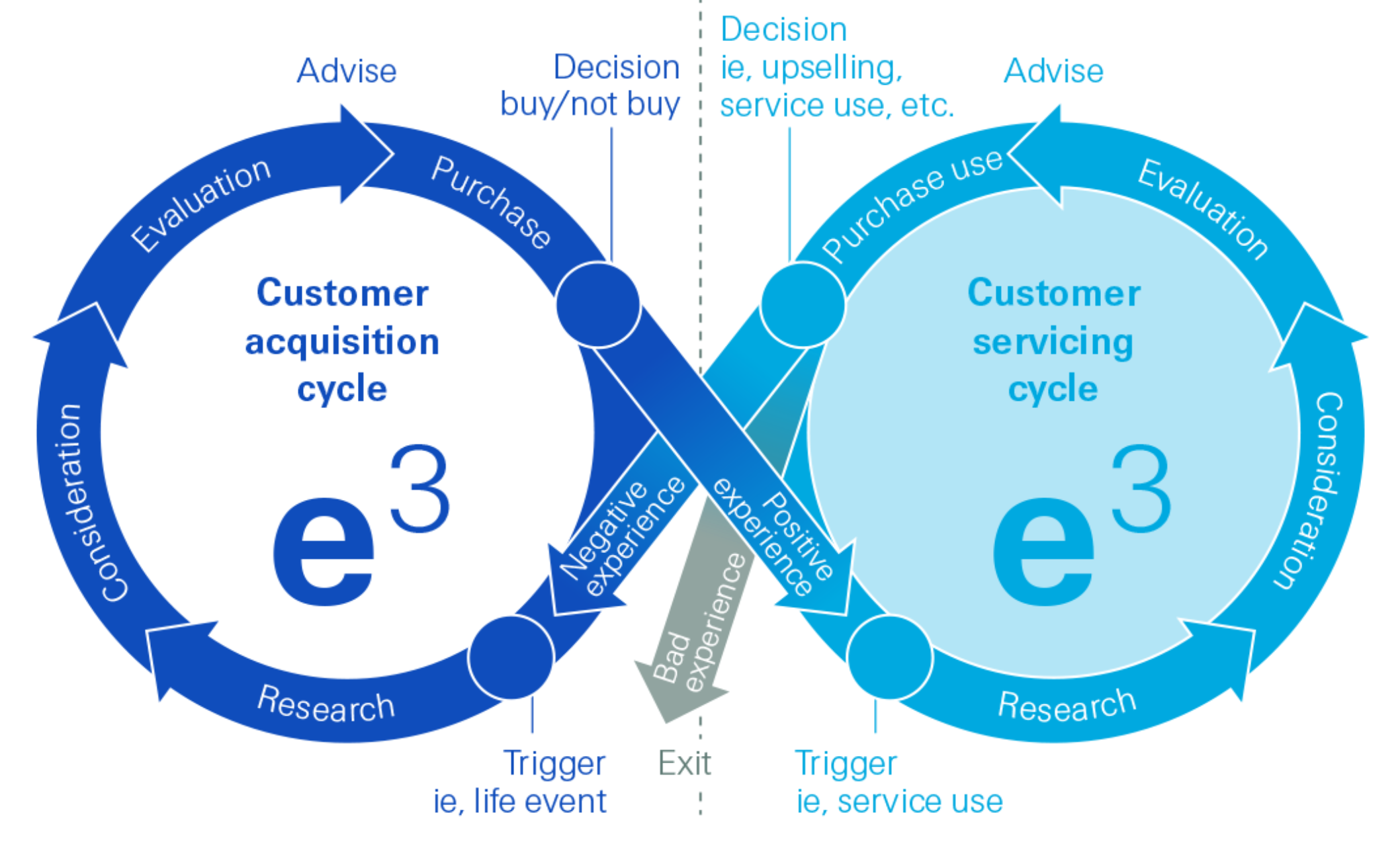

The authors (Corinne Fitzgerald, Aakash Kiran Raverkar and Evangelos Avramakis) argue that there are three ways to achieve this: through engagement, empowerment and emotional connection.

The e3 model they developed shows how to attract consumers, inspire loyalty and retain them. It prioritises experience-led interactions and helps insurers understand the necessary components to make an interaction successful.