How Wells Fargo learned to innovate around the customer

Wells Fargo, the world’s most valuable bank, learned to innovate around the customer.

In 1999, Steve Ellis, who runs the bank’s wholesale services group, went to a conference where Scott McNealy of Sun Microsystems described a completely new era of digital banking that would unfold over the next decade. Nobody else seemed impressed, but Ellis was transfixed. For him, it was an epiphany.

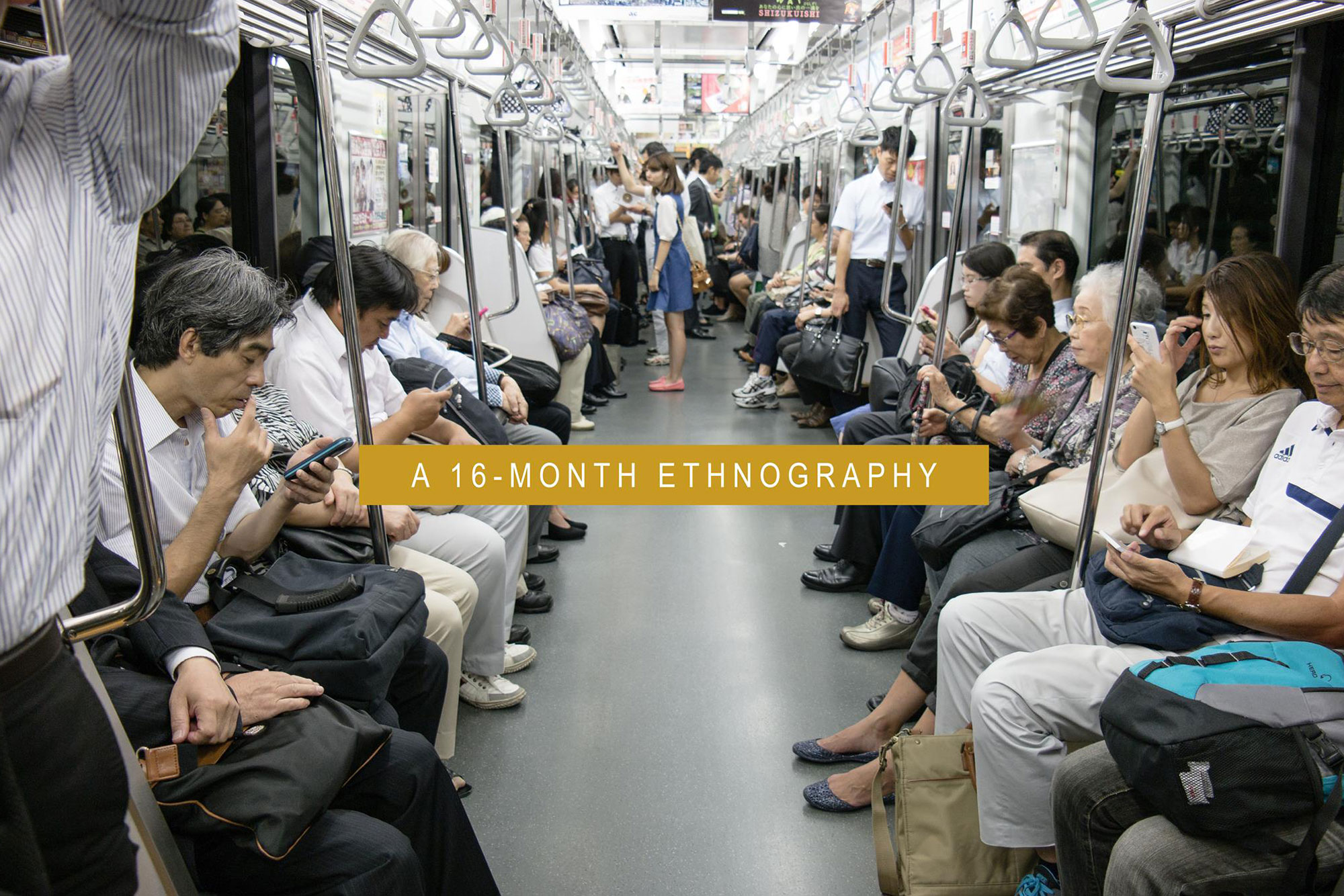

Ellis realized that technology could be used to make the customer’s life easier, streamlining processes to enhance user experience, but he also knew how “customer is king†initiatives could easily devolve into useless platitudes. He wouldn’t find answers in boardroom discussions, but would need to look beyond banking for insights.

So Ellis immersed himself in Internet culture and eventually hit on ethnography techniques, which ha been commonly used in consumer products companies like Procter & Gamble, but were completely foreign to the banking industry. At first intrigued, then excited, he sent his team for training at nearby Stanford university to learn how to perform ethnography studies.

It seemed to be exactly the answer he was looking for. Instead of having executives brainstorm in the corporate offices, they would get out and observe customers as they navigated often confusing banking routines. As they uncovered problems and experienced frustrations first-hand, they could devise solutions.”